Can You Still Get Free Fidelity Services With Aarp?

Ryan McGinnis / Alamy Stock Photograph

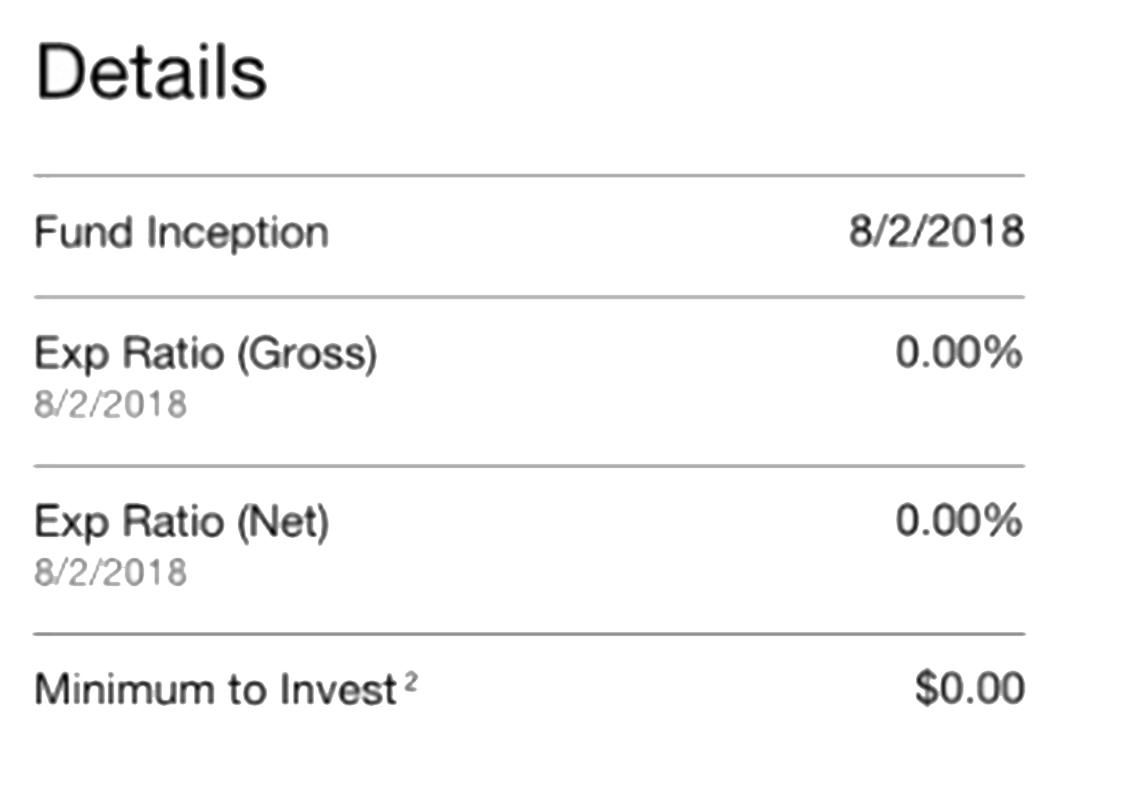

En español | Concluding week, Fidelity upped the ante in the race to lower index fund fees past launching two stock funds with no fees. That'southward not a typo — not low fees,no fees. The 2 funds are the Allegiance Nix Total Marketplace Index Fund (FZROX) and the Fidelity Zero International Stock Index Fund (FZILX). Both ain a very broad handbasket of U.S. stocks and international stocks, and at that place are absolutely no fees attached. Plus, in that location'southward no minimum investment.

The cost tag is tempting. But are these funds correct for y'all? I did some digging to aid answer that question.

Despite my skepticism, Allegiance spokeswoman Nicole Abbott confirmed that I could literally buy i dollar'south worth of either fund and the fee would be zilch. She explained that the house is charting a new course in index investing that benefits clients of all ages — from millennials to boomers — and of all affluence levels and life stages. I did a triple accept when I looked at this Fidelity chart:

Allegiance

My typical evaluation of whatever stock fund is based on two key criteria: maximizing diversification and minimizing expenses.

These funds are certainly diversified. According to Fidelity, the Zippo Total Market Index Fund owns 2,500 companies, and the international stock fund about two,300 companies. By comparison, the Vanguard Total Stock Market place ETF (VTI) owns about 3,638 companies, and the Vanguard Total International Stock ETF (VXUS) about 6,149 companies. The Vanguard funds are more diversified, especially in international stocks, as Vanguard owns small-cap firms, whereas Allegiance excludes them.

Yet information technology appears that Fidelity holds the edge when it comes to fees. Fidelity'southward 0.00 pct annual expense ratio is 0.00 percent, but Vanguard's Total Stock ETF is 0.04 percent, and the company'south Full International Stock Index Fund is 0.11 percentage.

Keep in mind that taxes are fees, too. When a fund sells stocks it holds, it can laissez passer on a capital gain to the shareholders. Although no one knows just how taxation efficient these two new funds will be, Elisabeth Kashner, managing director of ETF inquiry at FactSet Research Systems, points to Fidelity's existing index funds. She notes that the Fidelity Full Market Index Fund (FSTMX) generated 0.79 percentage in upper-case letter gains final year, which "for high-bracket taxable investors, capital gains distributions price over 0.19 percent in taxes." So for taxable accounts, the Vanguard funds could still be the lower-cost pick, though the Allegiance Zero funds win out for tax-deferred accounts such as IRAs.

Accuracy and trust

While expenses and diversification are the two cardinal criteria I use to compare funds, I also await at how well an index fund tracks the underlying index and how much I trust the fund family.

Typically, an index fund licenses the underlying index. Yous've probably heard of indexes such equally the Dow Jones Industrial Average and S&P 500. You can expect at how well the fund performed against that index. The difference is known every bit tracking error. The Fidelity Zero funds are a bit different in that they are self-indexed by Allegiance, so it may be harder to find tracking error for these new funds.

It should be noted, however, that the Vanguard funds I've been comparing these cipher index funds with have positive tracking error. A fund should underperform the total return of the index by the amount of fees being charged. Without getting into technicalities, Vanguard does things to start expenses, such as generating income past lending out some of the underlying securities; that income flows dorsum to shareholders.

Over the past decade, for example, the Vanguard Total Stock Market Index Fund matched the return of the index; in other words, the profits matched the expenses or netted a zero expense. Vanguard spokesman John Woerth stated that in 2017, securities lending kickoff 0.02 percent in fees for the Total Stock Market Index Fund and 0.07 percent for the Total International Stock Index Fund. Non all fund families credit the funds for this type of revenue. Fidelity's Abbott noted that some of Fidelity'southward acquirement from securities lending would menstruum through to shareholders but not did give specifics.

Trust is the area in which I idea I'd exist giving Allegiance a mediocre grade, owing to the fact that information technology is a for-turn a profit company and sometimes profits come before the fund holders. Simply Fidelity scored an A-plus. I've previously written inAARP The Magazine that buying the wrong index fund was 1 of my biggest mistakes. My first index fund, in the tardily 1980s, was a very competitively priced Dreyfus S&P 500 index fund that later raised its price and trapped me with higher fees. I would accept had to pay a huge amount in taxes if I had sold information technology.

Will Fidelity exercise the same and later raise fees? Non according to Abbott: "The expense ratios on the nix index funds are permanent." I tend to believe them, considering at almost the same time I bought the Dreyfus fund, I bought a Fidelity S&P 500 index fund and they followed Vanguard'south lead by cutting expenses. Now Fidelity is as well slashing fees on many existing index funds, including my S&P 500 index fund, to 0.015 per centum — significantly lower than Vanguard. In my opinion, the move to lower fees on existing index funds is at least every bit big of an declaration as the launch of the nada-fee funds.

My take

This is all good news for investors, and I applaud Fidelity both for launching these zero-price funds and for lowering expenses on existing index funds. I also commend others, such equally Schwab and iShares, for launching lower-price index funds. Fee wars benefit consumers.

Low- or no-cost broad index funds are the way to go, and any make is probably fine. But if you lot have to pay taxes to switch to a slightly lower-fee fund, don't. Information technology could have many decades for those lower fees to start the tax bite.

Allan Roth is the founder of Wealth Logic, an hourly based fiscal planning firm in Colorado Springs, Colo. He has taught investing and finance at universities and written forMoneymag, theWall Street Journal and others. His contributions aren't meant to convey specific investment advice.

Can You Still Get Free Fidelity Services With Aarp?,

Source: https://www.aarp.org/money/investing/info-2018/zero-fee-fidelity-funds.html

Posted by: nicholsalwat1946.blogspot.com

0 Response to "Can You Still Get Free Fidelity Services With Aarp?"

Post a Comment